Retained earnings represent portions of profit not distributed to shareholders but reinvested in the business or set aside as reserves for a particular purpose. A statement of retained earnings depicts the movement in retained earnings in a given period.

The statement of retained earnings outlines the earnings present at the beginning of the year and the portion transferred from the current year’s profits, ultimately resulting in the earnings at the year-end. Here are some examples that depict the statement of retained earnings and the calculations involved:

Download Corporate Valuation, Investment Banking, Accounting, CFA Calculator & others

Let’s take an example to understand the calculation of a Statement of Retained Earnings in a better manner.

You can download this Statement of Retained Earnings Example Excel Template here – Statement of Retained Earnings Example Excel Template

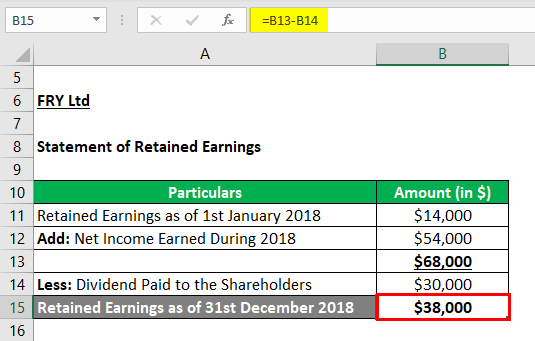

FRY ltd had an opening retained earnings balance of $14,000 carried forward from the year 2017. In 2018, it earned an additional $54,000 after all expenses were paid. It was then decided that $30,000 would be paid to the shareholders as dividends. Below is the calculation involved in checking the retained earnings at the end of the year 2018:

FRY Ltd

The concern shows a good propensity to retain the majority of the profits in the current year. The earnings help strengthen the owner’s equity. Also, given that the funds are obtained from within the organization, there is no dilution in the ownership, and the decision-making process of the shareholders will not be affected. Sourcing funds through this medium also incurs no cost. Another advantage of healthy retained earnings is no external agencies’ involvement in sourcing the funds from outside. Unless an exception arises, it should retain earnings as the chief form of sourcing funds.

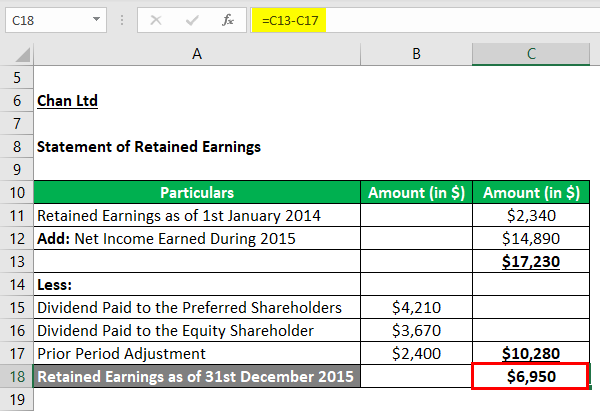

Chan Ltd started 2015 with an opening retained earnings balance of $2,340. It earned a net income of $14,890 during the year and paid a dividend to preferred shareholders amounting to $4,210 and the equity shareholders worth $3,640. There was also a prior period adjustment of $2,400. The retained earnings at the end of the year 2015 will be calculated as below:

The entity does not consider retaining earnings as a major source of funds. From the profit it earned during a year, it had a dual obligation to both the preferred and the equity shareholders, bringing down the amount that could have been retained. Also, prior period adjustments play a part in the ultimate retention. Companies must rectify any items erroneously passed in the previous year as prior period adjustments in the current year. They could either bring down or increase the profit in the present year.

For a statement of retained earnings, apart from arriving at the closing earnings balance through opening earnings and profits for the year, it is also useful if one could calculate the cost of retained earnings. Surprisingly, retaining the profits instead of distributing them to shareholders as dividends is associated with an opportunity cost. Also, if an entity retains earnings instead of distributing them to the shareholders, it risks displeasing them. Therefore, it is imperative that a good return may come up using the earnings.

In general, if no other specific factors and variables are mentioned, the cost of retained earnings equals the cost of equity multiplied by a reduction in the shareholder’s tax rate. This assumption implies the absence of floatation costs.

Cost of Retained Earnings = Cost of Equity * (1-Shareholders Personal Rate of Tax)

This cost of retained earnings should be compared with the cost of raising debt from the market, and the decision to limit the retention percentage should be taken accordingly. Suppose the cost of raising debt is lower. In that case, the funds are easily available, and unlike retained earnings, it provides the taxation benefit to the entity; then, the preferred method of obtaining funds should be from external sources.

The statement of retained earnings is a good indicator of the health of the company and the ability to be independent in the future. Organic growth using the funds generated by itself is always a preferred form of growth over utilizing funds from outside. But, the quantum of the earnings cannot be a definitive conclusion. Some of the industries which are capital intensive depend a lot more on the retained earnings portion than the outside funds.

Retention is also a direct factor in the policy of the entity. Even though there are adequate profits, companies commonly have limited retained earnings as they distribute most of the funds among the shareholders as dividends. Again, market conditions give a direction to retained earnings. Emphasizing retained earnings becomes necessary if borrowing becomes expensive, even with limited profits.

Generally, the following become determinants in the retained earnings policy

This has been a guide to the Statement of Retained Earnings Example. Here we discuss the introduction and Example of a Statement of Retained Earnings, a detailed explanation, and a downloadable Excel template. You can also go through our other suggested articles to learn more –

1207+ Hours of HD Videos

15+ Learning Paths

100+ Courses

40+ Projects

Verifiable Certificate of Completion

Lifetime Access

6133+ Hours of HD Videos

40+ Learning Paths

750+ Courses

40+ Projects

Verifiable Certificate of Completion

Lifetime Access

all.in.one: AI & DATA SCIENCE - 470+ Courses | 4655+ Hrs | 80+ Specializations | Tests | Certificates

4655+ Hours of HD Videos

80+ Learning Paths

470+ Courses

50+ Projects

Verifiable Certificate of Completion

Lifetime Access

7286+ Hours of HD Videos

150+ Learning Paths

990+ Courses

50+ Projects

Verifiable Certificate of Completion

Lifetime Access

all.in.one: FINANCE - 750+ Courses | 6133+ Hrs | 40+ Specializations | Tests | Certificates 6133+ Hours of HD Videos | 40+ Learning Paths | 750+ Courses | 40+ Projects | Verifiable Certificate of Completion | Lifetime Access

all.in.one: AI & DATA SCIENCE - 470+ Courses | 4655+ Hrs | 80+ Specializations | Tests | Certificates 4655+ Hours of HD Videos | 80+ Learning Paths | 470+ Courses | 50+ Projects | Verifiable Certificate of Completion | Lifetime Access